Buying a house is an exciting and important milestone for many people. But for those with bad credit, the process can be more difficult and time consuming. Fortunately, with some planning and preparation, it is still possible to purchase a home even with a less than perfect credit score. This article will provide a step-by-step guide to help you buy a house with bad credit.

Step 1: Check Your Credit Score

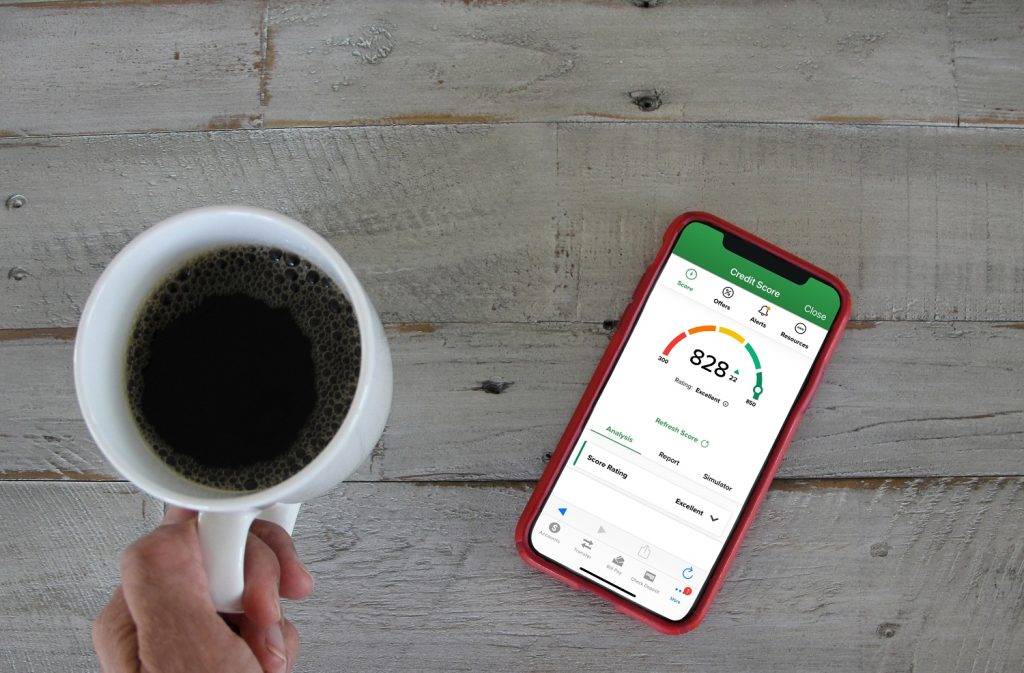

The first step to buying a house with bad credit is to check your credit score. Knowing your score will give you an idea of how lenders may view you and what kind of credit products you may qualify for. You can get your credit score for free from a number of sources, such as your bank or credit union. It is important to note that you may have more than one credit score, so it is important to check them all.

Step 2: Review Your Credit Report

Once you have your credit score, the next step is to review your credit report. This will give you an idea of what lenders see when they review your credit. Your credit report will include information such as your payment history, any collections you may have, and other financial information. It is important to review your credit report for any errors that may be affecting your score and to address any items that need to be resolved.

Step 3: Create a Budget

Creating a budget is an important step in the home buying process. It will help you determine how much house you can afford with your current income and expenses. Start by calculating your monthly income and expenses. Then, use this information to determine how much you can comfortably afford to spend on a new home.

Step 4: Start Saving for a Down Payment

If you have bad credit, it is important to save for a down payment. A larger down payment will help you qualify for a better loan and may help you get a better interest rate. Start by setting a goal for your down payment and create a savings plan to help you reach that goal.

Step 5: Start Looking for Homes

Once you have a budget and a savings plan in place, it’s time to start looking for homes. Start by searching online for homes in your price range. You can also work with a real estate agent to help you find the perfect home.

Step 6: Get Pre-Approved

Once you have found a home you like, the next step is to get pre-approved for a loan. This will help you determine how much house you can afford and give you an idea of what type of loan you may qualify for. When you meet with a lender, make sure to bring along your budget, credit report, and other documents that can help you get the best loan available.

Step 7: Negotiate

Once you have been pre-approved for a loan, it’s time to start negotiating with the seller. Negotiations can be a tricky process, so it’s important to have a plan in place. Try to get the seller to agree to a lower price or offer to pay closing costs.

Step 8: Get a Home Inspection

Before you commit to buying a home, it is important to get a home inspection. A home inspection will help you identify any potential problems with the home, such as plumbing or electrical issues, that you may need to fix before closing.

Step 9: Finalize Your Loan

Once you have negotiated with the seller and had a home inspection, it’s time to finalize your loan. Make sure to review your loan documents carefully to ensure that everything is in order.

Step 10: Close

The last step is to close on the home. This is when you will sign all the paperwork and transfer ownership of the home to you. Once the closing is complete, you can start settling into your new home.

Final Thoughts

Buying a house with bad credit can be a daunting task, especially if you are new to the process. With some preparation and the right steps, it is possible to buy a home even with a less than perfect credit score. Follow the steps outlined above to help you buy a house with bad credit.